salt tax cap repeal 2021

Revive remaining 2021 tax extenders. The tax cuts and jobs act imposed a 10000 cap on the itemized deduction for state and local taxes from 2018 through 2025.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Financial Planning Tax Planning.

. This cap remains unchanged for your 2021 taxes and it will remain the same in 2022 if Congress doesnt remove the cap in its spending bill. Daily News Editorial Board New York Daily News. Full repeal of the SALT cap is the worst option of all.

We examine how the repeal of the state and local taxes SALT cap in 2021 would affect federal revenue and the tax liabilities of taxpayers in each of the 50 states. SALT cap repeal is no middle-class tax cut New York the top 1 percent would get a tax cut of about 103000 on. Bill Pascrell D-NJ speaks at a news conference announcing the State and Local Taxes SALT Caucus outside the US.

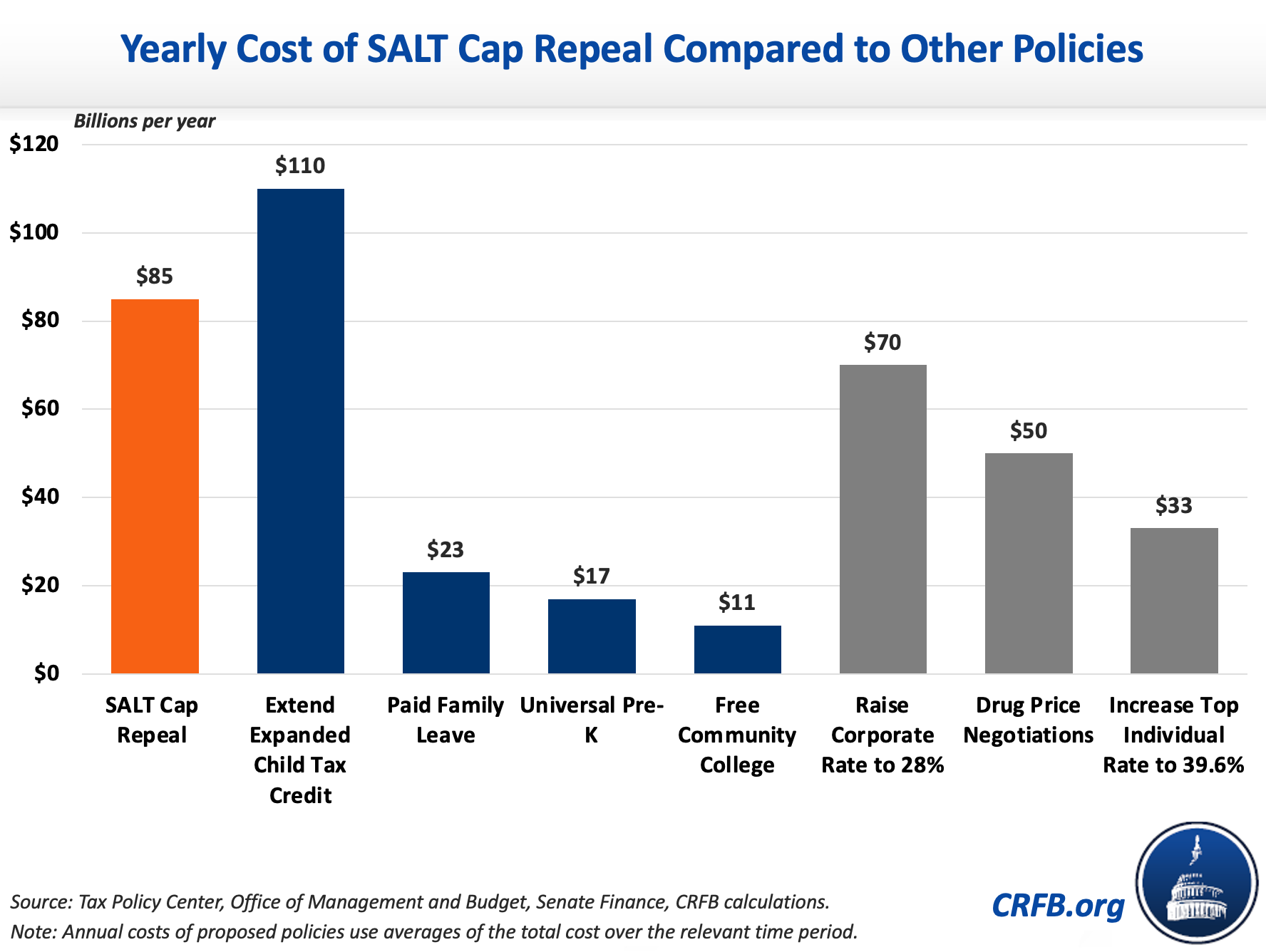

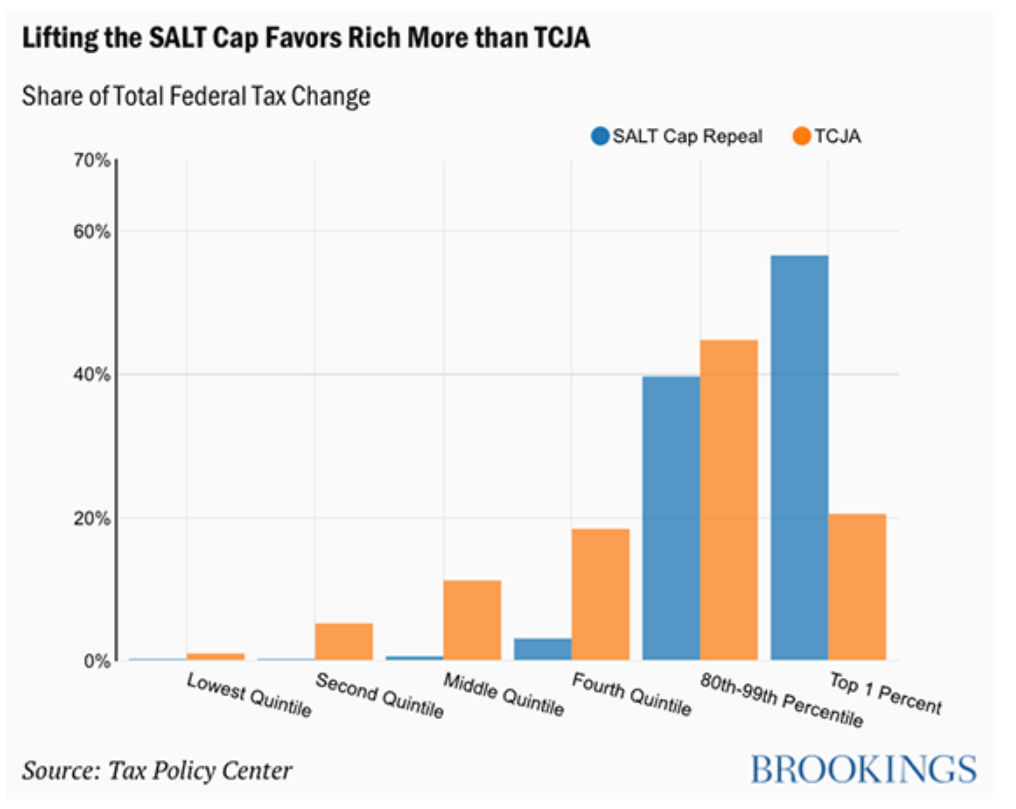

Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction according to. 2 days agoRepeal PAYGO Sequester 120 billion 12 trillion. SALT-Cap Repeal Gains Momentum.

By 2022 the proposed repeal of the SALT cap would mean that the federal government would get about 100 billion less in tax revenue each year. By Laura Davison News April 15 2021 at 0253 PM Share Print. By Ana Radelat November 4 2021 900 am November 4 2021 300 am.

WASHINGTON DC A group of New York lawmakers in a bi-partisan effort are pushing for a repeal of the 10000 cap placed on the State and Local Tax deduction better. Repeal the terrible SALT tax deduction cap. Would receive much larger tax breaks from a SALT cap repeal than those in lower.

September 29 2021. Capitol on April 15 2021. House Democrats are considering a five-year suspension of the cap on the federal state and local tax deduction before its reinstated in 2026 according to people familiar with.

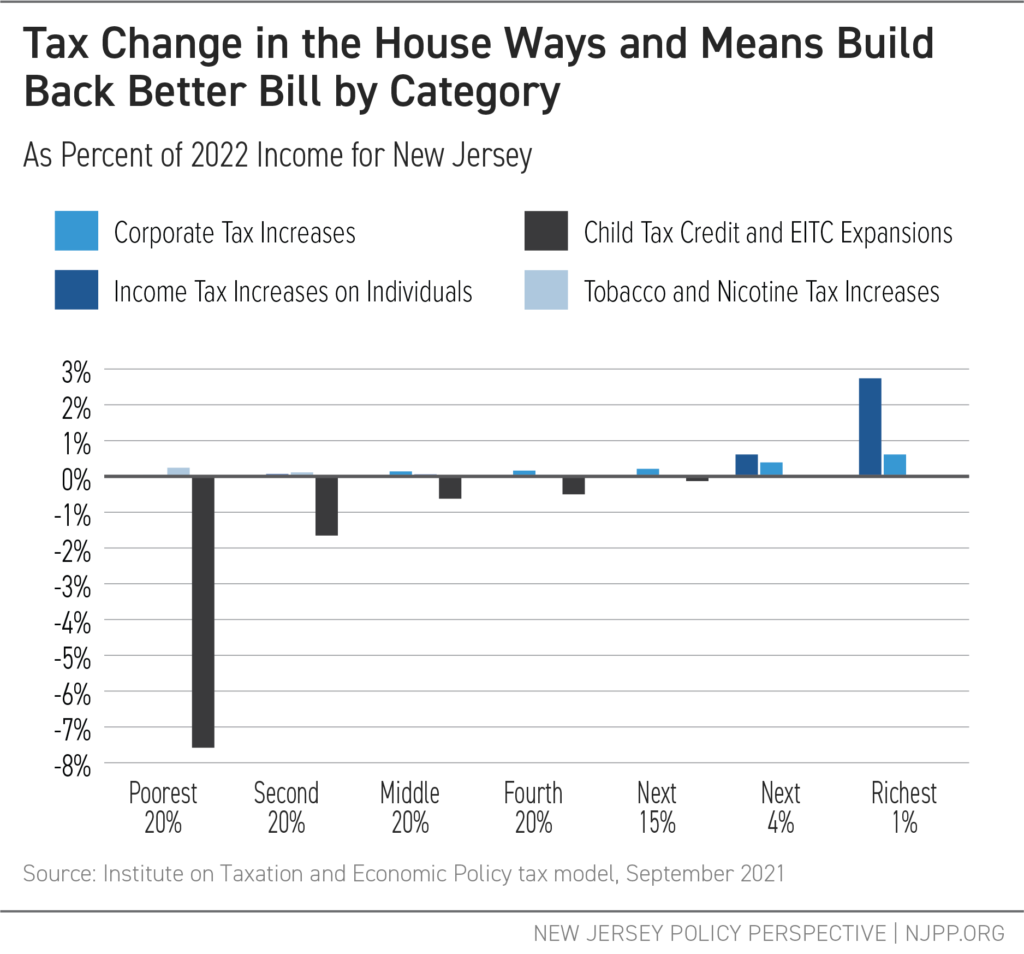

Combining SALT cap repeal with reinstatement of the Pease limitation and the prior-law AMT substantially reduces those benefits for high earners resulting in a 08 percent. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. Salt Tax Cap Repeal 2021.

But 61 percent of all. Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction. Shake on it.

Total - All Policies with PAYGO Sequester Repeal. The cap on the SALT deduction. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a.

The governor was referring to the Tax Cuts and Jobs Act passed in 2017 which included a provision that placed a 10000 cap on taxpayers SALT deductions. All three options would primarily benefit higher-earning tax filers with repeal of the SALT cap increasing the after-tax income of the top 1 percent by about 28 percent.

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

Marc Goldwein On Twitter For Everyone 1 Salt Cap Repeal Pays To Black Households It Pays 13 To White Households Https T Co Vauzg3fley New Iteptweets Study Shows 3 4 Of The Tax Break Goes

Salt Cap Increase Ok D By House Now Heads To Senate What May Change

How A Change To The Salt Cap Would Affect Taxpayers By State Bond Buyer

Salt Deduction Cap Repeal Gottheimer And Suozzi Discuss Tax Cuts

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

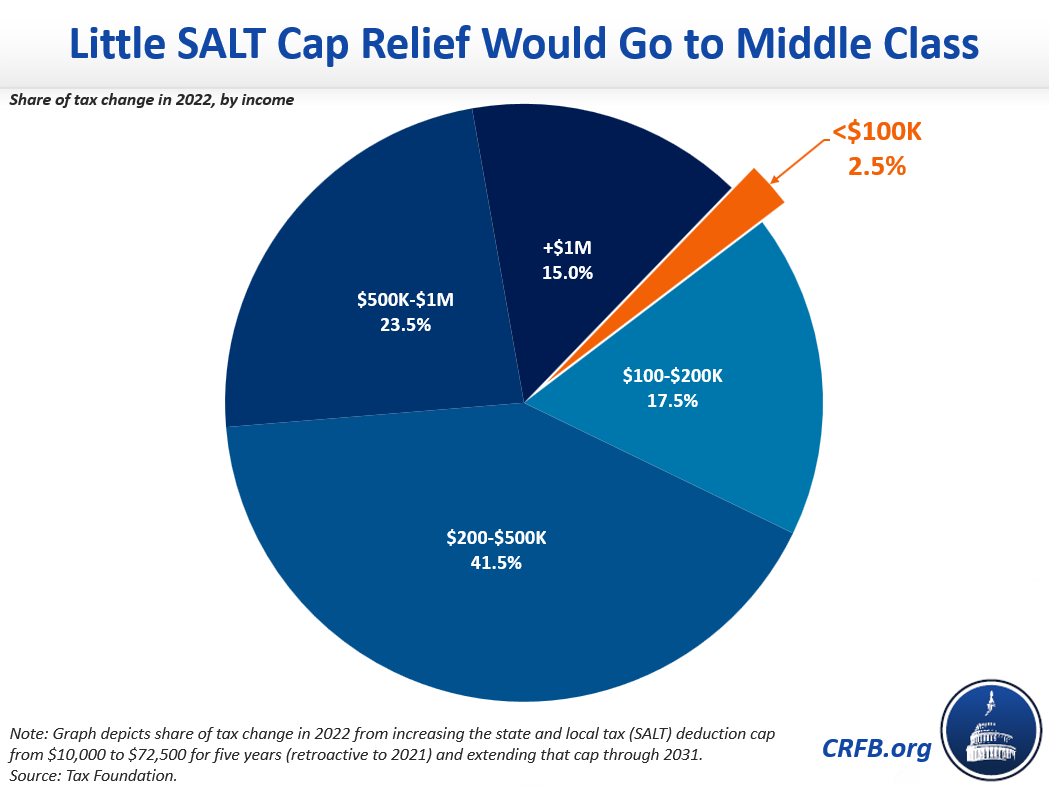

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

Why This Tax Provision Puts Democrats In A Tough Place Time

The Heroic Congressional Fight To Save The Rich

N J House Democrats Slammed For Support Of Spending Bill Without Salt Deal New Jersey Monitor

Build Back Better Legislation Makes The Tax Code Fairer But Only If Salt Cap Stays In Place New Jersey Policy Perspective

72 500 Salt Cap Is Costly And Regressive Committee For A Responsible Federal Budget

Marc Elrich Says Not So Fast On Salt Tax Cap Repeal

Salt Tax Repealed By House Democrats The Washington Post

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

How Raising The Salt Deduction Limit To 80 000 May Affect Your Taxes

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 1

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Aft On Twitter Repmikelevin The Salt Deduction Cap Was Built To Hurt The Middle And Working Classes And I Know That Common Sense Will Lead Us To Fix This Flaw In The